A Guide to Using the CODEX Exchange

CODEX is a new up-and-coming exchange, launching during the depths of 2018’s “crypto winter.” This guide will detail how to get set up on CODEX, and briefly outline some features that make it unique. CODEX are based in Estonia, have been audited for security, and are currently being audited for solvency and liquidity.

Setting Up

Getting signed up with CODEX is extremely easy. A simple email and enforced strong password are needed, along with email confirmation. Google two-factor authentication (2FA) is present and, of course, highly recommended as the basic strong measure of security. The site also supports Multi-Factor Authentication (MFA), and the exchange sends confirmation emails when it detects sign-ins from new devices or IPs.

CODEX make a big deal about their security features. The Scatter protocol, for example, is used by CODEX for handling account information. Essentially a dApp that is mutually compatible with Ethereum, EOS and Tron blockchains, Scatter takes the form of a multiplatform wallet, which uses a private key to sign into a blockchain-hosted account

This means that users can login to CODEX without a username and password. A similar functionality is also offered by the SimpleWallet protocol - an EOS-based wallet application - which lets users login to CODEX using just a QR code.

For plugging into API access, CODEX use a fancy cryptographic protocol called EdDSA - a variant of Schnorr signatures - to generate access credentials. And of course, the exchange say that they do not store the private keys, but only show them once to the user during creation before destroying them

CODEX also enforce HSTS policy for connecting to their servers. HSTS forces connections coming to the server to connect with the HTTPS protocol - a basic but important security feature for any website. This prevents so-called “Downgrade attacks,” whereby a server is convinced to communicate with an out-of-date connection protocol (like HTTP).

Trading Interface

The interface is clean and fast, with everything you need neatly spaced into the main trading window. A light/dark interface toggle is mercifully present and very functional. One nifty feature is that, using the “Demo” link from the main page, you can test this interface first without actually signing up.

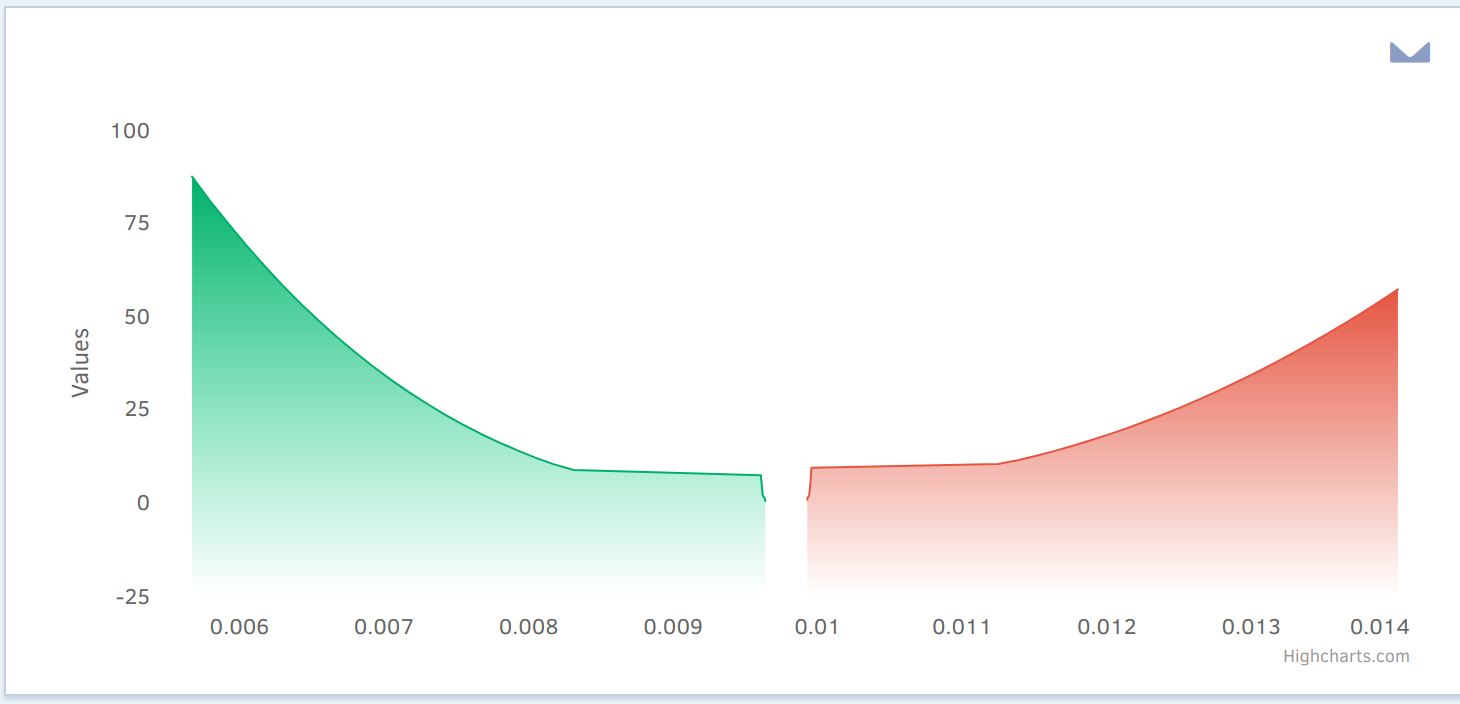

Nine languages are supported. The chart is an integrated TradingView chart - pretty standard but also probably the best in the business. The depth chart is, however, an integration of Highcharts.com and is very crisp.

Order types are plentiful, with Market, Limit, Stop Market and Stop Limit - as well as one additional and less typical one, the Scaled Order type. This is a very convenient way to do something very common but very necessary; but which function is rarely seen on cryptoasset exchanges.

Trading histories, both public and private, fill out the bottom section of the main window.

The platform offers a fiat gateway for Euros, Polish zloty, and Ukrainian hryvnia currencies, as well as a number of stablecoin assets including USDT, TUSD, and DAI. To deal in actual fiat deposits and withdrawals, the user will of course have to complete a KYC verification (ID, selfie, address). But for just crypto deposits and withdrawals, $2,000 (USDT equivalent) worth per day is allowed with no verifications.

Once KYC is done, though, depositing fiat is very convenient - and safe. Users can buy crypto on CODEX with debit and credit cards; and CODEX’s system is compliant with a rigorous information standard called the PCI DSS.

This means, according to an official blog post, that CODEX do not store any account information given to them by their customers. Rather, customer data is transferred directly to the payment provider where it gets verified with your bank.” So, because CODEX do not store sensitive account data, they also can’t lose or leak it.

Trade Mining

CODEX, like most exchanges, have a proprietary token (CDX) used for generating trading discounts and other benefits. For now, they offer 50% off trading fees, with a diminishing discount in subsequent years.

Half of these tokens are pre-produced (or pre-mined) and used in various capacities to get CODEX up and running. Nine percent of this pre-mined supply has gone to the team for development purposes, and 15% to early investors. The rest, 25%, is held in reserve for any unforeseen contingencies. All of this 49% of token supply is locked up for a 12 month vesting period, which will obviously help buoy the token’s price.

It’s important to point out that pre-mining is not a bad thing. Projects need funds to operate, and no-premine projects often run into trouble trying to fund operations - and sometimes die off.

The rest of the 51% of the tokens are “mined” by traders themselves during trading. Users receive CDX tokens by trading on the platform, and users who hold more tokens receive a scaling “multiplier” effect - thus receiving more tokens.

This means that, if CODEX takes off and does well, customers who have traded on the platform since the beginning could do very well in the future. Binance has set the standard, here, for exhibiting the power and potential value of exchange tokens, with their BNB tokens now collectively worth over $4.5 billion.

Summing Up

CODEX have a lot going for them. Their exchange has a secure and accessible fiat gateway for several fiat currencies; it has a robust suite of security features, as well as convenient and blockchain-utilizing login options; it looks good and is fast; it has an attractive “tokenomics” scheme for its inevitable proprietary exchange token, including a 49% lockup; and it has a good coverage of trading tools. It is audited for security and liquidity by third parties.

There is not much bad to contest this glowing evaluation. A recent delisting of 18 tokens - including some real winners like ChainLink (LINK) and Enjin Coin (ENJ) - seems questionable. And some people might prefer to avoid KYC requirements altogether, although that is getting harder and harder to do.

All in all, CODEX is definitely worth a try. While clearly based around an Eastern European user base, CODEX could be a global hit if it starts attracting a following.