Introduction to Nexo

Nexo offers crypto enthusiasts the best of both worlds - instant access to cash while retaining ownership of your crypto assets. You get an instant loan of up to $2M in 40+ fiat currencies using your crypto as collateral. By borrowing against your crypto you retain the entire potential upside of your assets and avoid any capital gains taxes that might arise from their sale.

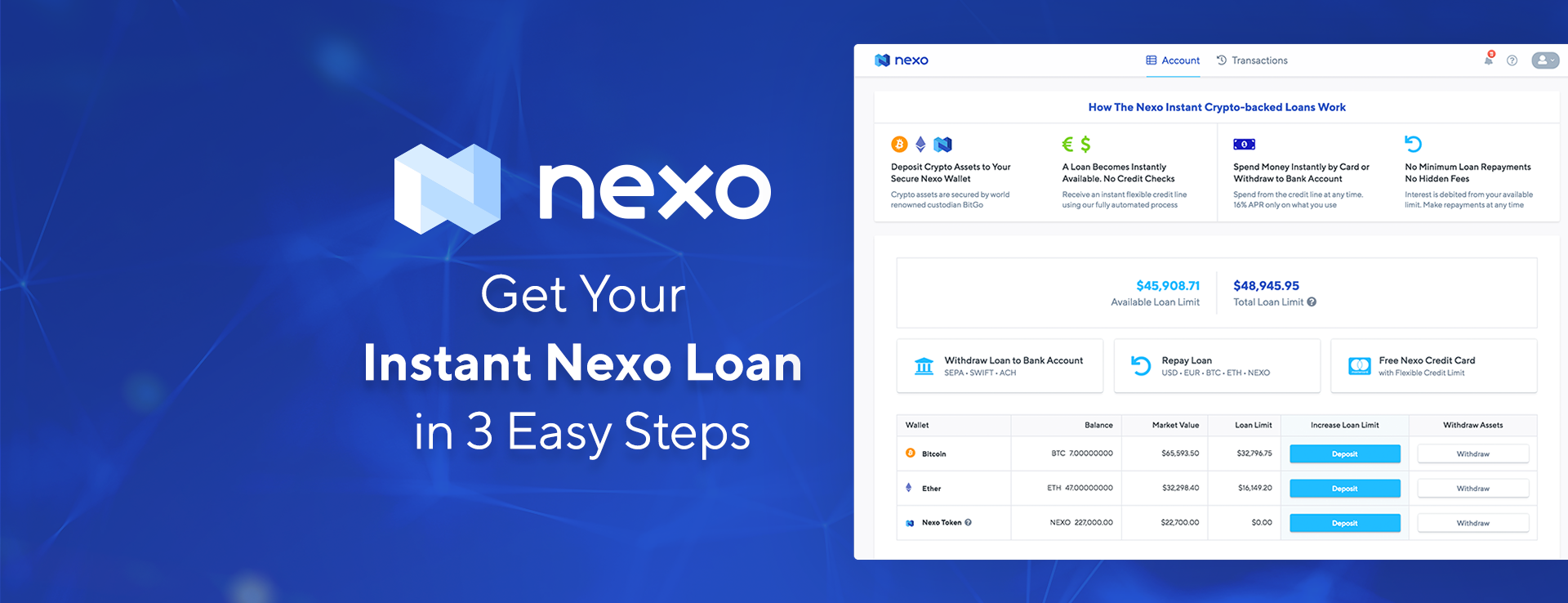

Get a Nexo Loan in 3 simple steps Getting started is incredibly easy. You need to complete 3 simple steps before receiving your first loan:

- Create a personal Nexo Account

- Deposit Crypto Assets

- Withdraw your loan

Watch the Nexo Product Demonstration below

Loan limits & Approval

Once your deposit on the network, the market value of your crypto is calculated in real time and a loan limit is extended according to the Loan-to-Value (LTV) ratio for this specific asset. The current collateral options available on the Nexo Platform are Bitcoin, Ethereum, XRP, NEXO, and BNB which provide LTV between 30% and 50%.

In other words, if you stake $10,000 worth of BTC, you will be able to withdraw an instant loan of approximately $5,000.

Loan Withdrawal

After the deposit, you can immediately withdraw your loan to your bank account or stablecoin address (Tether (USDT), TrueUSD (TUSD), Gemini Dollar (GUSD), USD Coin (USDC), Dai (DAI) and Paxos Standard Token (PAX). There are no credit checks - you usually get your cash in 24 hours or less.

Loan Terms

The annual percentage interest rate (APR) starts at 5.9% (when using the NEXO tokens as collateral or as repayment) and is capped at 11.9% APR when not utilizing NEXO Tokens.

No minimum loan repayments are required, flexibility at its finest.

Loan Repayment

You can repay all or some of your loan early at any time as you only pay interest for the days you borrow. You can make loan repayments using both crypto (BTC, ETH, etc.), including the collateral in your wallet, as well as fiat currencies (USD, EUR and 40+ other currencies).

Loan Example

Let’s say you want to buy a $20,000 car and instead of selling your Bitcoin, you would like to use it for an instant crypto-backed loan from Nexo.

- Loan Limit: $20,000 (available instantly, without credit checks)

- Deposit Required: $40,000 (worth of BTC, which stays yours)

- Interest: 5.9% per year APR (when repaying using NEXO, 11.9% otherwise)

- Daily Interest: ~$4.44 (debited daily from your available credit limit) No additional fees. No hidden charges. No installments.

NEXO Token

In addition to the 50% Discount on your interest rate, all NEXO Tokens kept in clients’ Nexo Wallets are entitled to 30% of the net profits of the company as dividends. As a profitable company from start Nexo is paying out the first ever dividend on a token on December 15!

Tax implications

Crypto Loans can also be an important tool for individuals and businesses looking to optimize their tax liabilities using the so-called “Billionaire Strategy” For decades billionaires like Mark Zuckerberg, Elon Musk and Steve Jobs have funded their lifestyle by borrowing against their stock.

By borrowing against your crypto assets, no sale occurs. Using Nexo can help you avoid a series of tax events while receiving fiat funds to cover your needs. With Nexo’s loans, you do not need to be a billionaire to take advantage of this simple strategy

Who can benefit from an Instant Crypto Loan?

Anyone. Individuals and businesses of all shapes and sizes use Nexo loans between $1000 and $2M to finance personal expenses or to pursue new lucrative investments. Some typical clients include:

- Crypto Miners

- Crypto Traders & Funds

- Cryptocurrency Investors

- Cryptocurrency Exchanges

- ICO & Crypto Companies

Important information

This website is only provided for your general information and is not intended to be relied upon by you in making any investment decisions. You should always combine multiple sources of information and analysis before making an investment and seek independent expert financial advice.

Where we list or describe different products and services, we try to give you the information you need to help you compare them and choose the right product or service for you. We may also have tips and more information to help you compare providers.

Some providers pay us for advertisements or promotions on our website or in emails we may send you. Any commercial agreement we have in place with a provider does not affect how we describe them or their products and services. Sponsored companies are clearly labelled.

Opera

Opera

Safari

Safari